Libertex Review

Table Of Content 👇

Libertex is an online trading and investment platform operated by Indication Investments Ltd and is part of the Libertex Group, which was established in 1997. Today, the group serves more than 2.9 million clients worldwide and employs over 700 professionals. Libertex has earned over 45 international awards, including recognition as Best Trading Platform at the recent Forex Awards.

| 💱 Instruments | CFDs in Forex, Cryptocurrencies, Metals, Indices, Stocks, Oil and Gas, Agriculture, ETF |

| 💳 Funding & Withdrawal | Credit Card, Giropay, iDeal, Neteller, Rapid Transfer, Skrill, Sofort, Trustly, Visa, Wire Transfer |

| 💻 Broker Type | MM | STP |

| 👨🏽💻 Account Types | Demo, Real Account |

| ⌛️ Language | English, French, Spanish, Italian, German, Dutch, Polish, Thai, Vietnamse, Chinese, |

| 🎮 Virtue | Free & Variety Education |

Pros / Cons

- Trade on over 200 instruments

- Fast withdrawals

- Fully regulated broker

- 20+ years’ experience

- Lots of technical analysis tools

- Libertex is used by Indication Investments Ltd and is regulated and authorized by CySEC.

- Wide range of payment methods.

- Access to MT4 and MT5

- Zero spreads on all accounts and instrument types

- Charges for some deposit/withdrawal methods

- Only provides access to CFD derivatives trading

- There is no copy-trading compatibility

- Limited amount of educational resources

Account Types

Libertex keeps things simple by offering a single account type for all traders, ensuring the same trading conditions and features across the board. With a minimum deposit of just $50, it’s accessible for beginners while offering enough flexibility for experienced traders.

Trading Platforms

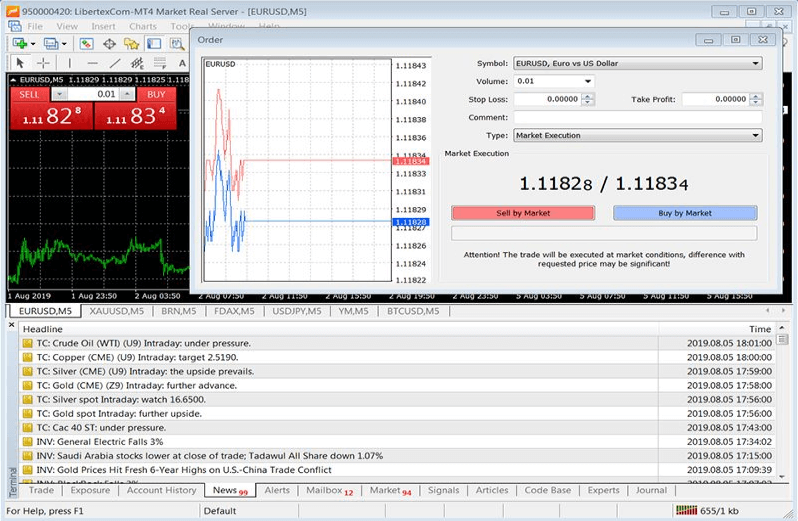

Clients can trade using MetaTrader 4 (MT4), MetaTrader 5 (MT5), or the proprietary Libertex Web Platform.

-

MT4/MT5: Industry-leading platforms with advanced charting, algorithmic trading capabilities, and integrated copy trading features.

-

Libertex Web Platform: A streamlined, web-based solution with built-in analytical tools and market insights to support trading decisions.

Mobile trading

The Libertex mobile app offers a smooth trading experience on the go, with detailed charts, multiple order types, and a user-friendly interface. For traders who prefer it, MetaTrader 4 is also available on mobile devices.

What Can I Trade

Libertex provides access to a diverse selection of over 300 instruments, including:

-

50+ currency pairs

-

70+ cryptocurrency pairs

-

17 commodities

-

26 index CFDs

-

130+ equity CFDs

-

10 ETFs

Leverage

Maximum leverage for major currency pairs is 1:999, with varying limits for other asset classes such as minor currencies, commodities, indices, and cryptocurrencies.

Spreads & Commission

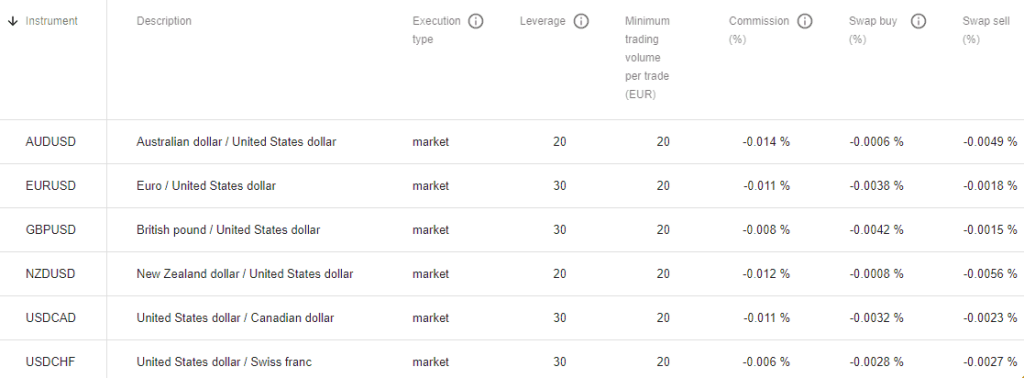

Libertex offers competitive spreads across its range of markets. Trading costs depend on the instrument and market conditions.

Spreads vary by asset and market, but Libertex remain competitive across most trades.

Libertex rollover

Also, always consider rollover or overnight fee as a cost, which is charged on the positions held longer than a day and determined by the particular instrument. The example of swaps you may also see in the table above.

Overnight Fees(Swap)

Positions held overnight may incur a rollover fee, calculated based on the instrument and position size. Details can be checked directly on the trading platform before placing a trade.

Bonuses and Promotions

Libertex provides a 100% deposit bonus, time-limited to 90 days. It forces trading, and I cannot recommend it. A Loyalty Program is also available, but Libertex does not outline the benefits to the trading conditions. It prides itself on more trading signals, and I want to stress again that they were part of the reason for the suspension of its CySEC license. The bonuses and promotions are only available from its South African subsidiary, and I advise traders to stay away from them.

Deposits and Withdrawals

From time to time, Libertex may offer promotions or loyalty rewards in certain regions. Availability depends on your country of residence and applicable regulations.

When it comes to withdrawals, the options include PayPal and Skrill which incur zero withdrawal fees, while credit/debit card, SEPA bank transfer, and Neteller withdrawals incur a small withdrawal fee.

Minimum deposit

The minimum deposit to start trading is $50. Both new and experienced traders have access to the same account features and trading conditions.

Deposit fees

Libertex does not charge any commission for deposits from their side, yet make sure with the payment provider in case any other internal fees are applied. Also, Libertex may add on a withdrawal fee, which varies by the payment method, while Skrill is Free of Charge, 1% is added for Neteller transfers, or 0.5% for International bank transfers.

Low - Variable

Low - Variable