City Index Review

Table Of Content 👇

City Index is an industry-leading broker for forex, CFDs and spread betting. Here, we comprehensively review their offering. An in-depth look at trading platforms, mobile apps, fees, demo accounts, and more.

| 💱 Instruments | Currencies, Crypto, Indices, Metals, Energies, Softs, Stocks, Bonds, Interest Rates |

| 💳 Funding & Withdrawal | Credit cards, Bank Transfer, Payoneer, PayPal, Bpay |

| 💻 Broker Type | STP | ECN |

| 👨🏽💻 Account Types | Demo, Micro, Mini, Standard, Managed Account |

| ⌛️Language | English, Spanish, German, Arabic, Polish, Chinese |

| 🎮 Virtue | Regulated in three tier-1 jurisdictions, guaranteed stop loss |

Pros / Cons

- Strict regulation in multiple jurisdictions

- Tight spreads & fast execution speeds

- Commission free trading

- User-friendly trading platforms

- Large selection of trading tools

- No deposit/withdrawal fees

- Trading Central research tool

- Expert market analysis

- Real-time financial news from Reuters

- Trading signals

- Dedicated client relationship manager

- Educational trading academy

- 24/5 customer support

- No US clients

- Inactivity fee

- No Islamic accounts

In this detailed City Index review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

City Index Overview

City Index is a one of the world’s leading trading brokers, established in 1983 and headquartered in the UK with over 150,000 traders worldwide using their services. They have over 35 years of experience with fast and reliable trade execution speeds, award winning platforms and technology across multiple devices. They offer over 12,000 markets to trade including Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, Options, Bonds, Spread Betting, CFDs & ETFs.

City Index are committed to offering industry leading trading services with fair and transparent pricing, risk management, excellent customer support, whilst giving clients peace of mind by being authorised and regulated by the Financial Conduct Authority (FCA). They have strict regulation in 8 jurisdictions across the globe. This helps to ensure traders that they are trading with a trusted and reliable broker.

City Index is considered by many as a stable and secure trading broker with the resources to continue offering innovative and industry leading trading standards. This makes them a more favourable choice of broker compared to other brokers who have only been in business a few years and do not have the financial backing or long-term success that City Index has.

They have great financial strength with a proven track record of delivering superior trading conditions to traders worldwide. Financial results are publicly available with full transparency. Forex.com is another trading broker under the same umbrella which further emphasises the size of the company. Please refer to our Forex.com review for more information.

City Index have won numerous awards including best Spread Betting Provider 2019 from the Online Personal Wealth Awards, best CFD Provider, best Mobile application, and best Cryptocurrency Trading Platform at the Online Personal Wealth Awards 2018. They have also won “Best MT4 Broker” at the UK Forex Awards 2017.

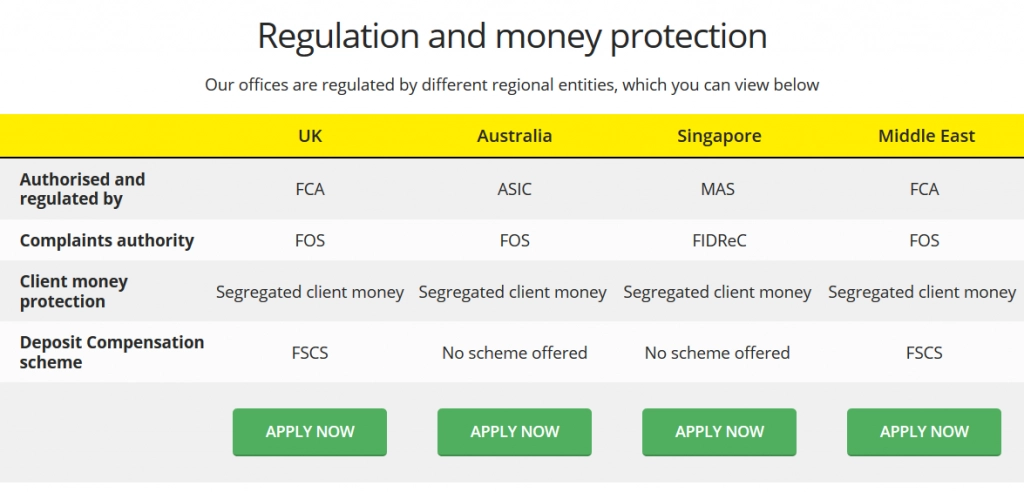

City Index Regulation

City Index are regulated in an impressive 8 jurisdictions. City Index is a trading name of StoneX Financial Ltd. StoneX Financial Ltd is a company registered in England and Wales. StoneX Financial Ltd is authorised and regulated by the Financial Conduct Authority (FCA).

They are also regulated by the well-respected Australian Securities and Investment Commission (ASIC) and Monetary Authority of Singapore (MAS).

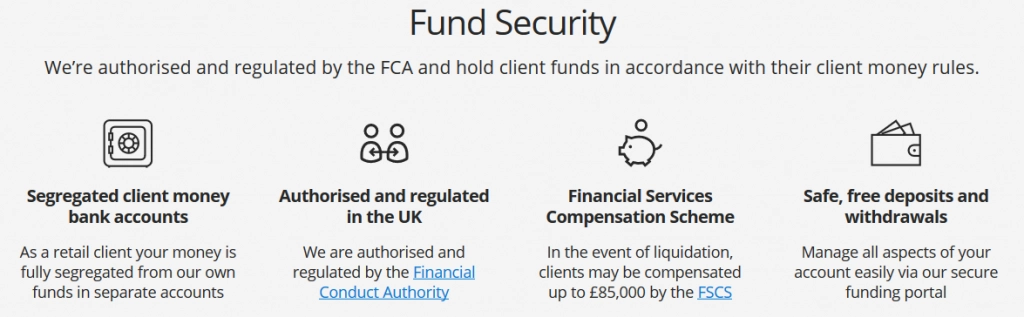

Using a strictly regulated trading broker helps to ensure security of client’s funds. City Index hold client funds in accordance with regulators client money rules. Client’s money is protected by being held in segregated top-tier bank accounts, separate from their own.

City Index clients are also protected by the Financial Services Compensation Scheme (FSCS) and in the event of liquidation, clients may be entitled to compensation of up to £85,000 through this scheme.

City Index Countries

City Index accept traders from all across the world, excluding USA, Canada, Afghanistan, Angola, Belarus, Belgium, Burundi, Central African Republic, Chad, Congo, Cote D’Ivoire, Cuba, Equatorial Guinea, Eritrea, Guinea, France, Guinea-Bissau, Haiti, Hong Kong, Iran, Iraq, Israel, North Korea, Lebanon, Liberia, Libya, Myanmar, New Zealand, Nigeria, Sierra Leone, Somalia, Sudan, Syria, Turkmenistan, Uzbekistan, Venezuela, Western Sahara, Yemen, Zimbabwe.

If you are located in one of the above countries, you may wish to consider another trading broker provider such as Forex.com. They accept traders from across the globe, excluding Singapore, New Zealand, Belarus, Iran, Yemen and some countries from the OFAC list.

Some City Index broker features and products mentioned within this City Index review may not be available to traders from specific countries due to legal restrictions.

City Index Platforms

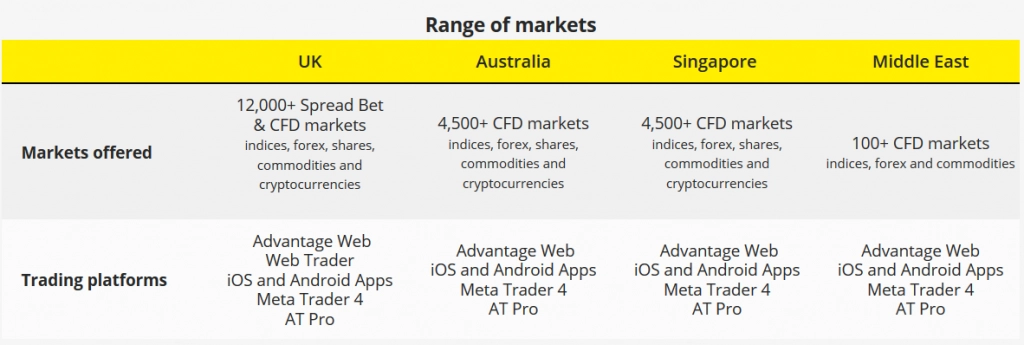

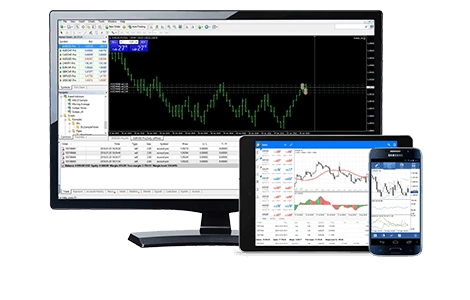

City Index provide traders with fast, flexible, reliable, award-winning trading platforms and technology across multiple devices, including desktop, web and mobile. There is a platform for all styles and experience levels of traders.

The City Index trading platforms can be customised to suit individual traders needs with over 16 chart types, real time news from Reuters built-in and 80+ technical indicators to assist you with your market analysis. Users can enable one click trading and set maximum slippage on orders.

Web Trader Platform

The powerful City Index Advantage Web platform features advanced customisable charts with a range of intelligent trading tools and custom indicators. It incorporates fast and reliable HTML5 technology for a reliable trading experience. You can configure and personalise multiple workspaces with the ability to switch between workspaces in a single click. The online platform has smart trade tickets that include trade risk management. Stops and limit orders can be placed in points, profit/loss or price. This provides a more convenient method to modify orders. The real-time margin calculator can help to keep your trading decisions under control. The platform is easy enough to use for new traders whilst having enough advanced functionality for the more experienced investor.

The web trader platform key features include:

- Powerful HTML5 technology: Fast and reliable HTML5 technology powers optimum performance

- Fully Customisable Platform: Switch between multiple personalised workspaces for ultimate flexibility

- Intelligent Trading Tools: Smarter trade tickets with advanced risk management options

- New Advanced Charts: Trade through charts with custom indicators and precision drawing tools

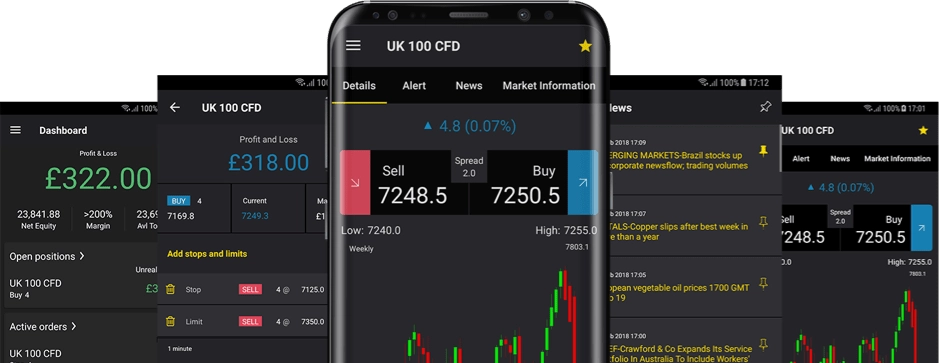

Mobile Trading Apps

City Index offer mobile trading apps for iOS and Android so that you can access your account wherever you are in the world at any time, from your smartphone or tablet. These apps provide secure 24-hour account access, live charts and pricing with built in Reuters news feed and economic calendar. Using the mobile trading apps, you can place and manage orders on the go.

The mobile trading platform key features include:

- Trade anytime, anywhere: Trade across multiple devices, open on your desktop, close on your smartphone or tablet

- Live TradingView charts: Plan your next trade with full-screen TradingView charts and a range of 60+ technical indicators

- Reuters news: Receive the latest global investment news from Reuters in the app

- Trade across devices: Trade on desktop, close on mobile or tablet. City Index accounts work on multiple devices

- Personalised watchlists: Create and amend multiple watchlists, to keep an eye on your chosen markets

- Economic calendar: Keep up-to-date with market events with the global economic calendar

- Device syncing: All your account details, history and preferences are synced between devices

- Live chat: Speak directly to City Index’s customer service team instantly through live chat

Desktop Trading Platforms

The downloadable desktop platforms available to use with City Index are AT Pro and the hugely popular MetaTrader 4 (MT4).

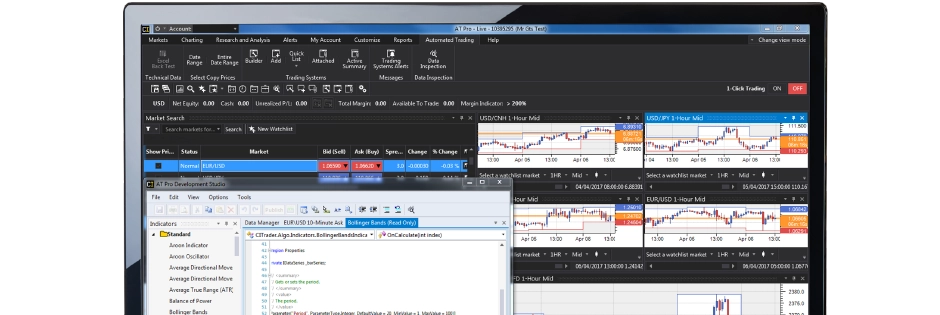

AT Pro Trading Platform

AT Pro is designed for advanced traders who need more powerful analysis tools with improved speed and efficiency. It includes a fully customisable layout so that you can build your own personalised trading templates in C#, .NET and Visual Basic or choose from the hundreds of pre-built trading templates.

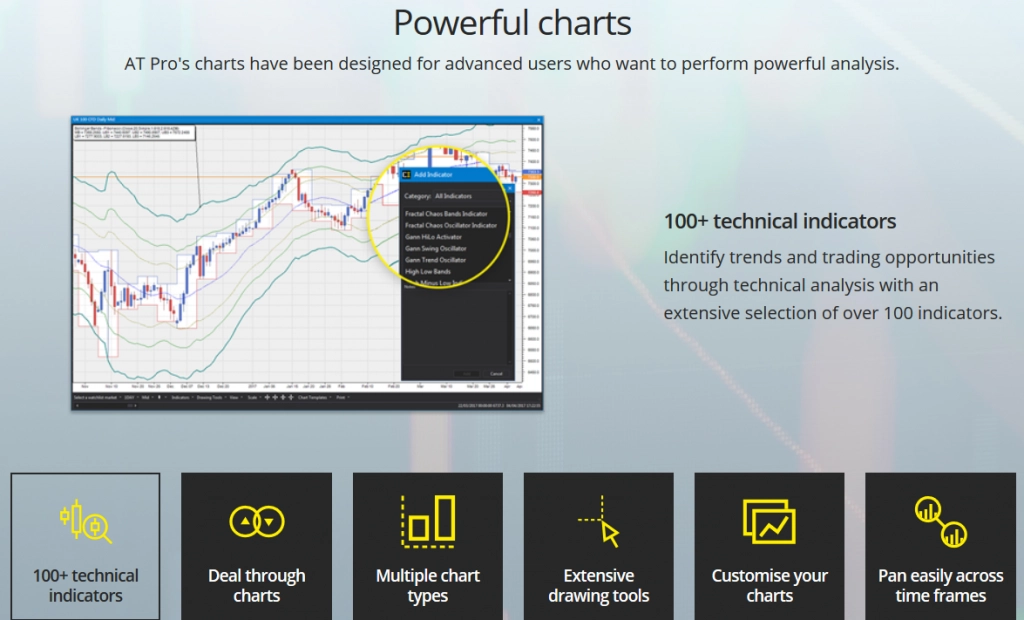

AT Pro has an advanced charting package with over 100+ indicators and a vast range of drawing tools for your market analysis. There is a back testing excel tool that allows you to test trading signals performance over historical data. It also has a customisable economic calendar, real-time news from Reuters and analysis portal that automatically scans the markets for chart patterns based on technical and fundamental analysis. This can save time from manually researching the market and present potential trading opportunities.

The AT Pro trading platform key features include:

- Powerful charts

- 100+ technical indicators

- Deal through charts

- Multiple chart types

- Multiple timeframes

- Extensive drawing tools

- Customisable charts

- Economic calendar

- Real-time news from Reuters

- Technical and fundamental analysis portal

AT Pro Trading Signals

- Trading signals: Trading signals instantly display potential trade entry and exit points on charts for greater accuracy

- Choice of templates: Choose from over one hundred free templates and customise them based on your requirements

- Create your own: Create your own unique trading templates in C#, .NET and Visual Basic with AT Pro’s Development Studio

- Back testing: Use the free back-testing excel tool to see how trade signals have performed against historical data

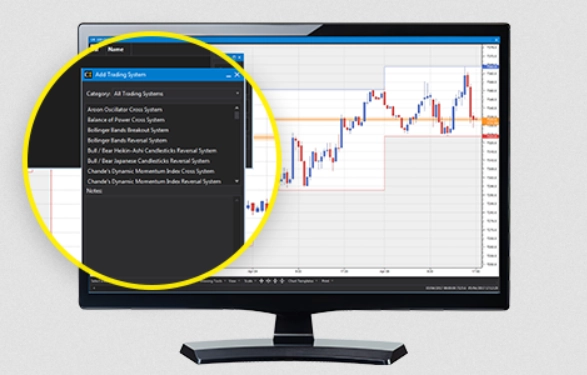

MetaTrader 4 Trading Platform

The MetaTrader 4 (MT4) trading platform is available with a wide range of built in features which are further enhanced by City Index’s service, support and pricing. Developed by Russian software company MetaQuotes, MT4 is perhaps the most widely used trading platform and considered by many as the most user friendly. It has a quick learning curve making it an attractive proposition to new traders whilst having enough advanced functionality for the more seasoned trader.

Through MT4 you can conduct a range of thorough technical and fundamental chart analysis using the numerous indicators that it incorporates, create your own custom indicators, automated trading systems known as expert advisors (EAs) and much more. In addition to the hundreds of built in tools, you can download thousands of free customised indicators, scripts and EAs. There is also a large online MetaTrader community where users from around the word share trading tools, strategies and signals.

When you trade forex and other markets with the City Index MT4 platform you can benefit from ultra-tight spreads, fast trade executions and unique trading tools. MT4 is provided for free on Windows, Android and iOS platforms. You can trade directly through your MT4 account on all platforms.

The MT4 trading platform key features include:

- MT4 is one of the most popular Forex trading platforms globally

- Real time bid/ask quotes in the market watch window

- Hundreds of built in indicators, scripts and drawing tools for detailed chart analysis

- Fully automated trading supported with expert advisors (EAs)

- Strategy tester to back test EAs over historical data

- Create or download customised tools including indicators and EAs

- Multiple timeframes, chart styles and order types

- Save and load trading strategy templates

- Fully customisable interface to suit your trading style

- Vast online community to share ideas with

- Access multiple platforms with one trading account

- Alert notification via email, SMS and platform pop-ups

- Suitable for traders of all experience levels

City Index Trading Tools

City Index provide a range of tools to encourage traders to improve their trading skills and knowledge. These tools include a selection of order execution types, market intelligence and a powerful research portal to help you identify potential trading opportunities.

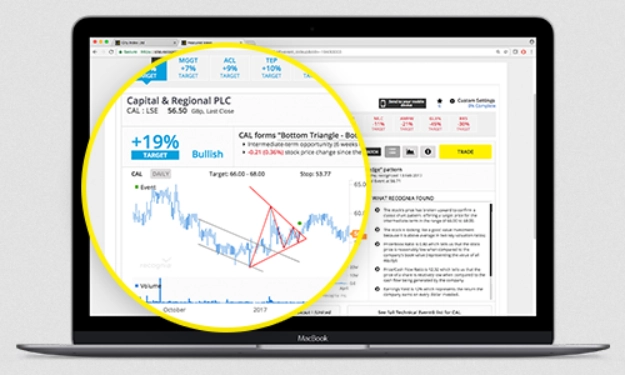

Research Portal

The City Index technical analysis research portal, powered by Trading Central, will save you time by scanning the markets for chart patterns and trade setups. The fundamental stock analyser shows if a stock is considered overbought or oversold at a glance.

Trading Strategies

The AT Pro platform has hundreds of trading strategies built in that can be used for trading signals to compliment your own trading plan. Strategies include moving averages cross system, Heikin-Ashi candlesticks reversal system and a MACD fast line/signal line cross system.

Reuters Financial News

Real-time financial news from Reuters provides you with data and market reports directly into all trading platforms and apps. This is a great way to keep up to date with the latest market news and to assist with fundamental analysis.

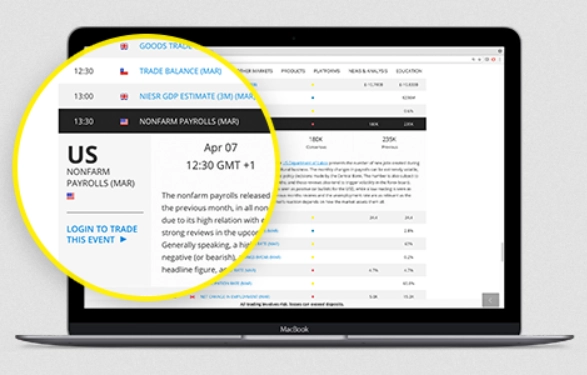

Economic Calendar

The City Index economic calendar is fully customisable and can help to show the possible impact of key news releases to help plan your trading strategies around.

Expert Market Analysis

City Index have a global research team that provides expert market analysis to help forecast potential market movements and trading opportunities.

City Index Education

Whatever your level of trading experience is, City Index provide a large amount of educational material to help improve your trading knowledge and skills. This includes educational videos, articles, webinars, tutorials, and practical examples of trading topics.

There is a City Index trading academy with trading guides covering everything from an introduction to the different financial markets to trading strategies and chart analysis. You can learn how to use a trading strategy, how to analyse the charts using technical and fundamental analysis, how to apply risk management to your trades and much more.

You can also keep on top of the latest market news with City Index’s expert analysis. They even provide clients with an experienced relationship manager for insight and trading support.

City Index Instruments

Through City Index, you can trade on over 12,000 global markets with a Spread Betting, CFD Trading or MT4 account. Trading instruments include over 80+ FX currency pairs, 20+ Indices, 4,500+ Global Shares, 25+ Global Commodities, Cryptocurrencies including Bitcoin and other markets (Bonds, Options, etc). It can be a good idea to opt for a trading broker who offers so many different markets and trading instruments in case you wish to branch out and diversify your portfolio in the future.

City Index Accounts & Fees

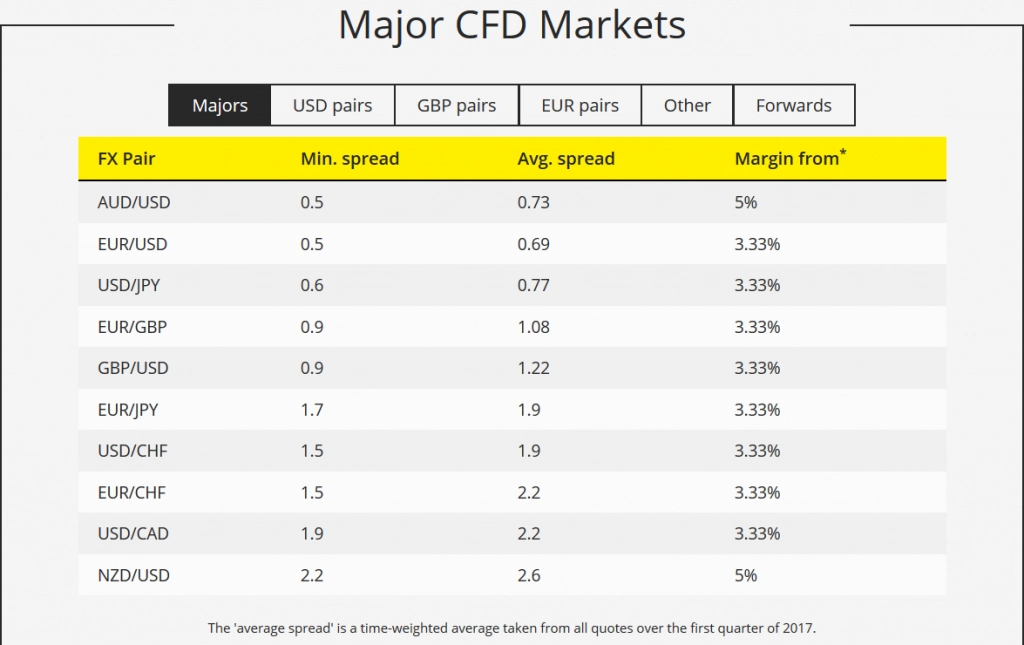

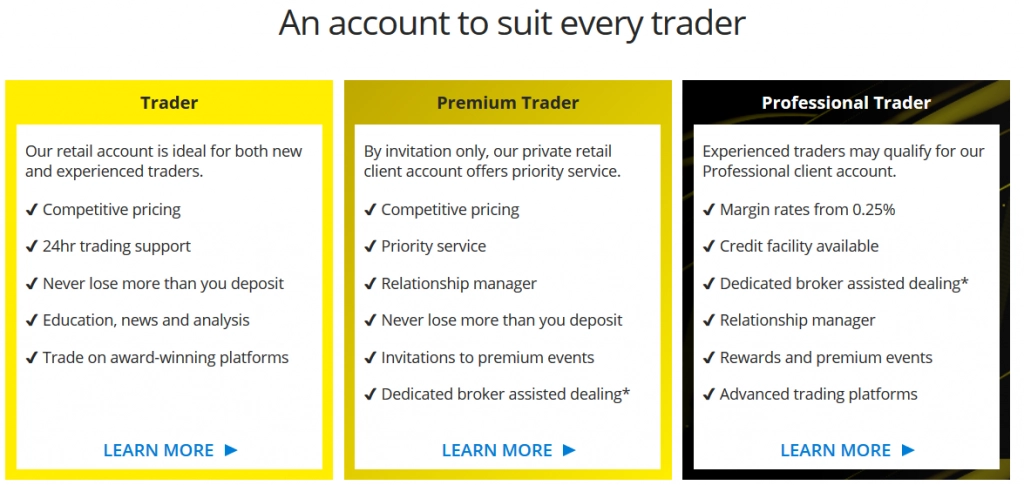

City Index offer a selection of different trading accounts that allow for fast, easy payments and secure withdrawals. If you are primarily looking to trade currency pairs, the Spread Betting and CFD accounts will give you full access to their FX range with spreads from just 0.5 points. City Index accounts tend to have tight spreads, low margin requirements and fast trade execution speeds. Minimum deposit starts from $100.

City Index do not charge any additional commissions on spread betting markets. They also do not charge commissions on CFD or FX markets, with the exception of CFD equities.

Each City Index account will give you access to all trading instruments although to use the AT Pro trading platform, the professional trader account is required. There is an inactivity fee to be aware of if you do not use your account.

City Index also provide users with demo accounts if you would like to test the different trading platforms and conditions before opening a real account. Do keep in mind that factors such as slippage and spreads can vary from demo to real accounts.

Trader Account

The “Trader” account is aimed towards both new and experienced retail traders, offering competitive pricing, 24-hour trading support, award winning platforms, news, analysis, education and more. This account includes a risk management feature with negative balance protection so that you never lose more than you deposit and margin close-out as standard.

Premium Trader

The “Premium Trader” account is an invitation only private retail account that comes with a priority service. It also has competitive pricing, negative balance protection with the added benefits of a relationship manager, invitations to premium events and dedicated broker assisted dealing.

Professional Trader

The more experienced traders who meet certain criteria can apply for the “Professional Trader” account. To qualify as a professional trader, you would need to have made a significant amount of transactions over the past year, have a large portfolio and work experience within the financial sector.

This account includes increased leverage, monthly cash rebates on FX and Indices trades, a credit facility and broker-assisted dealing, lower margin rates, rewards and premium events as well as a dedicated client relationship manager. It is worth noting that there is no negative balance protection on this account.

As broker fees can vary and change, there may be additional fees that are not listed in this City Index review. It is imperative to ensure that you check and understand all of the latest information before you open a City Index broker account for online trading.

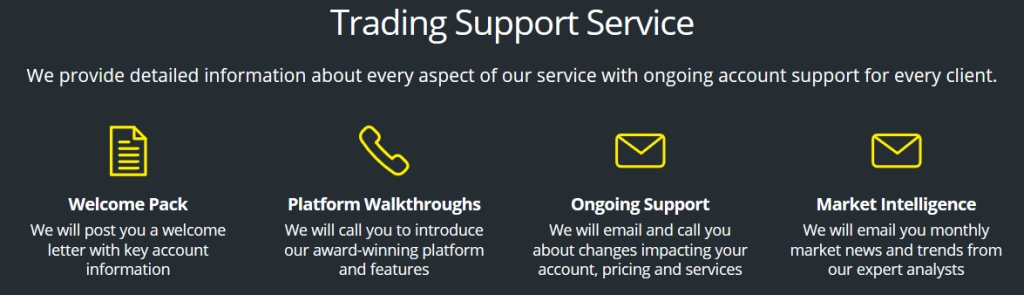

City Index Support

City Index have some FAQs for help and support whilst the client services team are available 24 hours a day, 5 days a week to answer any particular questions that you may have. Support is available via online chat, phone or email. They offer clients introduction calls, ongoing support and monthly newsletters.

City Index Deposit & Withdrawal

City Index provide deposit and withdrawals via wire transfer, credit/debit card and PayPal. You can manage your account easily through their secure funding portal.

Fees may be charged when using certain payment methods. Bank transfers can take a few business days to clear. Accounts can be opened in USD, GBP, EUR, CHF, JPY & NZD. The various different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

City Index Account Opening

It is quick and easy to apply for an account at City Index. You simply choose the account type that you require and complete a short online form. Once that is done, you need to verify your email and upload proof of identification and address. After they have been received and approved, you can then fund your account and commence trading.

City Index FAQ

What is the City Index minimum deposit?

The City Index minimum deposit is £100 or the equivalent in your account base currency. This is the amount you will need to deposit to get a live trading account with the broker. The relatively low minimum deposit means that you can try out the brokers products and services with a minimal investment to see if they are suitable for your needs before considering a larger investment. This is better than some brokers who require a minimum deposit of £500 and some even thousands.

How do I deposit money into City Index?

You can fund your account via the MyAccount portal which you can access via the platform. City Index accept various funding methods including the following:

- Debit card: Visa, MasterCard, Maestro & Electron

- Credit card: Visa, MasterCard

- PayPal

- Bank transfer

You can fund your account by direct bank transfer although the broker does not accept cash payments paid directly into their bank account, and they are unable to accept third party payments. Any such transfers will be rejected and returned to the original source.

You will find the brokers bank details and information about depositing funds into your account via direct bank transfer in the MyAccount portal. Funds can only be deposited in the Base Currency of the account.

Citibank cards cannot be used to fund accounts held with any spread betting provider. If you wish to fund from a Citibank account you will need to do this via BACs or CHAPs.

You may only fund your account with one PayPal account and the name on your PayPal account must exactly match the name on your trading account, otherwise the payment could be rejected.

The minimum PayPal deposit amount is £10. The maximum you can deposit via PayPal per transaction is £50,000.

Domestic bank transfers are usually completed in normally 3–5 business days, if your bank subscribes to the faster payments service it could be in 1 working day. PayPal and card deposits are usually instantaneous but can take up to 48 hours to complete.

What are the City Index deposit fees?

City Index does not charge any fees for deposits made by credit card, debit card, and bank transfers (i.e. BACS, CHAPS, or Internet Banking / Faster Payments). PayPal charges a service fee plus a percentage of the total amount deposited. This amount will be deducted from your deposit.

If the base currency of your trading account is not the same as the funds being deposited via PayPal, you will be charged as a conversion fee. You will see this amount before completing the deposit.

How do I withdraw money from City Index?

You can withdraw funds from your account via the MyAccount portal which you can access via the platform. You can withdraw money from your City Index account using the same methods accepted for deposits, such as Wire Transfer, Credit or Debit Card and PayPal.

For compliance purposes, client refunds can only be returned to the original funding source. For example, if you deposit funds into your account via debit card, funds will be returned to you via the same debit card, which must be registered on your account.

The name and address on your City Index account must match the name and address on the bank account you would like the withdrawal to be processed to. You can withdraw money to any of your registered payment cards, but the card has to have already made a successful deposit.

You may withdraw all or part of your money from your account at any time, as long as it is not already committed to any open trades. If you withdraw all of your funds your account will still remain open for future use.

The minimum withdrawal amount is £100, or all your available account balance (whichever is lower). Online the maximum you can withdraw in a single transaction is £20,000. If withdrawing online on credit cards there is a limit of £20,000 in 24 hours.

When you have withdrawn money such that all the deposits you made using your cards are zero, then you will be able to withdraw any excess funds in your available balance back to any registered payment method.

You can only withdraw up to the same amount deposited via PayPal. You cannot withdraw any higher amount than has been deposited via PayPal.

You should allow 3–5 working days for any card withdrawals. While domestic bank transfers are done in normally 1–2 working days, if your bank subscribes to the faster payments service it could be in 1 working day. PayPal withdrawals are usually instant but can take up to 48 hours.

What are the City Index withdrawal fees?

City Index do not charge any withdrawal fees, they are free of charge. You may want to check with your bank or PayPal if there will be any receiving or currency conversion fees when you make a withdrawal.

What is the City Index commission fee?

City Index does not charge any additional commissions on spread bet markets. They also do not charge any commissions on CFD or FX markets, with the exception of CFD equities.

CFD equity commissions vary by market, for UK and most European equities the charge is 0.08% of the consideration, for most US equities it is 1.8CPS and for most Asian equities it is 0.2%. The minimum commission rates are £10, $10 or €10.

Details on the commission rates for each equity can be found within the Market Information sheets on the platforms.

As with most brokers, there is an overnight holding fee (financing fee). The financing is a fee that you pay to hold a trading position overnight on leveraged trades. Essentially it is an interest payment to cover the cost of the leverage that you use overnight.

The daily financing fee will be applied to your account each day that you hold an open position (including weekend days). The financing rates are set at benchmark regional interest rate +/- 2.5%.

Overnight financing charges are applied to positions that have no set expiry date, for example trades for both spread bet and CFD. Financing is applied at 17:45 each day for most markets.

You will not pay a finance charge on futures trades as they already have the cost of carry built into the spread. If you have a hedged position open overnight, you will be charged overnight financing on both sides of the trade.

Are there any City Index inactivity fees?

Yes, City Index do charge an inactivity fee. If you have not used your account for 36 months (retail clients) or 12 months (professional clients) it will be deemed inactive. ‘Activity’ is defined as placing a trade and/or maintaining an open position during this period. Placing an order on an account without executing a trade will not qualify as ‘Activity’ for these purposes. A monthly inactivity fee of £12 in aggregate (or your cash balance if less than £12) will be applied for accounts that are inactive for 12 months or more.

What are the City Index account types?

City Index offer a selection of trading accounts for different trader needs. You can choose between the personal trading account, premium account and professional account. The main difference between the account types are the trading instruments offered, pricing and platforms. Your country may determine if you can open a spread betting or CFD account, or both.

City Index do offer joint accounts and corporate accounts.

Is there a City Index demo account?

City Index offers demo accounts for CFD, spread bet, joint CFD and spread bet and MT4 accounts. Your demo account gives you 12 weeks unlimited access to over 12,000+ markets. It comes with a balance of £10,000 for you to trade risk-free. While it is not possible to extend the duration of a demo account, if you feel you need more time to practice trading, you can always apply for another one.

Demo accounts are intended to enable you to familiarise yourself with the tools and features of the brokers trading platforms. Success or failure in simulated trading bears no relation to probable future results with any live trading that you may choose to engage in, and you should not expect any success with the Demo Account to be replicated in actual live trading.

Please note that a demo account cannot always reasonably reflect all of the market conditions that may affect pricing, execution and margin requirements in a live trading environment. Margin and leverage settings may vary from time to time between your demo account and a live account due to live account setting changes imposed as a result of elevated market volatility or other factors.

What are City Index spreads?

City Index have very competitive spreads, from 0.1% each side of market spread on Spread Bets and tight spreads from 0.5 points on FX. These are low spreads considering the majority of trading instruments do not incur a commission fee.

What is the City Index leverage?

City Index offers different amounts of leverage depending on the product and your country, but the maximum leverage is 1:200 in the UK for professional clients, 1:30 in Australia, 1:50 in Singapore.

When you trade CFDs, you can trade on leverage, this means that you only have to deposit a small percentage of the total trade value to gain a similar level of exposure to the markets. E.g. A leverage ratio of 1:30 means that for every $1 in your account, you can place a trade of up to $30.

Whilst this can increase profit potential, it also significantly increases potential risk. It is therefore imperative that you have a clear understanding of what leverage is and how it works, before you trade with leveraged positions.

What are the City Index margin & stop out levels?

Margin is the amount of money you need to deposit with the broker in order to place a trade and maintain that position. When you place the trade, you must have enough net equity (cash and unrealised profit & loss) in your account to pay the margin requirement for that trade and the commission (if applicable) and/or any charges including the spread. Margin is not a fee; it is deducted from your account and returned when the position is closed.

The margin requirements differ according to market, asset class and position size. You can find out the specific margin of each instrument in the Market Information sheet on your trading platform.

For retail clients, the share margins are typically 20% on the most popular shares whilst the margins for Indices CFDs such as the UK 100 and Wall Street start at just 5%. The margins for major currency CFDs start at 3.33%, and commodity CFDs start from just 10%.

For professional clients, the share margins are typically 3% on the most popular shares whilst the margins for Indices CFDs such as the UK 100 and Wall Street start at just 0.25%. The margins for major currency CFDs start at 0.25%, and commodity CFDs start from just 0.5%.

If your margin level is at or below the margin close out (MCO) level, City Index are required to close any or all of your open positions as quickly as possible; this is to protect you from possibly incurring further losses.

You should monitor your margin level carefully, as you should not expect to receive a margin call or warning prior to closure. The Margin Level Indicator on the trading platform makes monitoring your margin level very easy.

Do City Index allow hedging, scalping, news trading & expert advisors?

City Index does not allow scalping but they do allow hedging. You can trade automated systems with expert advisors (EAs) and may trade around the news if you wish. Just keep in mind market volatility and slippage/spreads around these times.

Is there a City Index Islamic account?

No, there isn’t a City Index Islamic account option at this time.

What are the City Index trading instruments?

City Index have a huge selection of over 12,000 markets for you to choose from. Whatever your interests, there is something for everyone. They offer CFDs, spread betting and options.

You can trade CFDs on major global indices in the UK, US, Europe, Asia and Australia, including 1-point spreads on the UK 100, Germany 30 and France 40.

At City Index you can use CFDs to trade on thousands of shares listed across world markets, including the UK, US, European and Asian stocks. Margins start from 20% on individual shares, with commissions as low as 0.08% of the total trade value.

They offer tight spreads and low margins on over 40 major and minor currency pairs including GBP/USD, EUR/USD and USD/JPY. The forex CFDs include Spot and Futures and margins start from 3.33%.

You can trade CFDs on a wide range of precious metals. The spreads start from 0.4 points for gold and 2.5 points for silver.

At City Index, you can trade CFDs on US and UK crude oil, cocoa, coffee, sugar, pork bellies, wheat, soybeans, orange juice and oats. The spread for US crude oil is just 4 points.

They offer competitive CFD spreads on a number of bond markets including US Bonds, Euro Bunds and UK Gilts. The CFDs for bonds start from just 0.5 points.

How do I open a City Index live account?

Applying for a financial spread betting and CFD trading account with City Index is quick and easy and they have an account type to suit you, whatever your trading goals.

To open a City Index account, you can either click the link on the top of your trading platform or use the “create account” link on the brokers website. You can then apply in a matter of minutes by completing the simple and secure online application form.

As a regulated brokerage firm, they are required to ensure that the products are suitable for applicants. Therefore, they will ask you questions about:

- Your personal details

- Which products you want to trade in your account (spread betting, CFDs or both)

- Your financial status

- Your trading experiences

It is important that you answer the questions accurately as it may impact your ability to open an account. Your application will be considered based on your individual circumstances; these include both income and savings.

As part of the application process you’ll be asked to confirm the type of account you wish to open: CFD, Spread Bet, or both (in a single account).

As soon as your account has been opened, and you have funded your account you will be free to trade.

How do I verify my City Index account?

The time taken to open an account depends on the speed at which they can verify your identity. During the application process, the broker will perform an online check to confirm your identity. If you successfully pass the identity check you will be notified immediately. In some cases, you made need to provide supporting documentation in order to pass the checks.

If you are asked for this then they will usually require copies of one document for proof of identity and one for proof of address. You will receive an email detailing specifically what they need.

The following are examples of documentation that could be requested:

- Identification documents: machine readable passport, machine readable national identity card, photocard driving license.

- Proof of address (dated within the last three months): utility bill, council tax bill, bank or credit card statement, mortgage statement.

What is the City Index trading platform?

Depending on which account you sign up for (CFD/Spread Bet or MT4), you will be able to access Web Trader, iOS and Android mobile apps, and MT4 mobile, tablet and downloadable platforms.

On desktop, in addition to the Web Trader platform, they also offer the Advantage Web Online Trading Platform.

On mobile, they have the City Index Trading Apps for iOS and Android devices, which can be downloaded from their respective app stores. You can access your account(s) on any of these platforms.

They also offer MetaTrader 4 (MT4), which requires a specific City Index MT4 account to log in with.

The City Index platforms are user-friendly and contain an abundance of trading tools for conducting in-depth market analysis across multiple chart types and timeframes.

Where can I download the City Index platform?

You can download any of the City Index trading platforms directly from the brokers website or the relevant app stores. The web platforms can be launched directly in your web browser without needing to download or install any additional software. All of the trading platforms come without any costs or strings attached. That means you are free to download one or all of them, and it won’t cost you a thing.

Where is City Index located?

City Index is part of GAIN Capital and is a spread betting, FX and CFD Trading provider based in the UK. The company is headquartered in London and has offices in the United Kingdom, Australia, Singapore and Dubai.

Is City Index regulated?

Yes, City Index is regulated by top-tier authorities, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) and the Monetary Authority of Singapore (MAS).

This is an impressive range of regulators covering multiple jurisdictions. It shows that City Index must comply with strict rules that are put in place to protect investors all over the world.

What countries do City Index accept?

City Index welcomes clients from most countries. However, there are certain countries (e.g. USA & Canada), whose citizens would be unable to open an account with them due to their domestic financial regulations. However, this is very rare and the vast majority of countries are eligible.

Is City Index a scam?

No, City Index is not a scam. They are part of the GAIN Capital Holdings, Inc. group of companies, who are listed on the stock exchange. They are a multi-regulated brokerage firm that have been providing trading products and services to clients across the globe since way back in 1983.

How can I contact City Index support?

You can get in touch with the City Index support team via live chat, telephone and email. They are available 24/5 and happy to help with any general, technical or account related questions that you may have. From our experience, we found them to be efficient with their responses to a variety of questions.

City Index Summary

City Index are a very robust and well-established trading broker that is regulated in multiple jurisdictions and cover a huge range of trading instruments across multiple markets.

They offer some of the most advanced trading platforms and tools whilst having an abundance of educational materials for traders of all experience levels.

The account types offered are flexible enough to suit each individual trader needs, whilst the spreads are very competitive, execution speeds fast and customer support excellent.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Low - Fix&Var

Low - Fix&Var