LiteFinance Review

Table Of Content 👇

| 💱 Instruments | Currencies, Indices, Metals, Energies, Softs, Stocks |

| 💳 Funding & Withdrawal | Wire Transfer, Credit Card, Crypto, Skrill, Neteller, UnionPay |

| 💻 Broker Type | Broker |

| 👨🏽💻 Account Types | Cent, Classic, ECN |

| ⌛️ Language | Arabic, Chinese, English, French, German, Greek, Indonesian, Italian, Japanese, Korean, Portuguese, Russian, Spanish, Turkish, Hungarian, Polish, Swedish, Malay, Thai, Vietnamese |

| 🎮 Virtue | Low stock CFD fees |

Visit Broker

Pros / Cons

- Used by 2,000,000+ traders

- Established in 2005

- Regulated by CySEC

- Min. deposit from $50

- Quick and easy account registration

- Excellent bonuses available in some locations

- Up to 1:1000 Leverage.

- 8 Platforms, including MetaTrader4/5 and cTrader

- Webinars, Tutorials

- Account Funding 100% automatic.

- IB partner program with tailor made solutions for every partner

- Minimum deposit is only $50

- Tight forex spreads

- Currency converter available on official site

- Comfortable and safe trading

- Not overseen by any top-tier regulator

- Some complaints online about difficulties withdrawing funds

- Wide spreads on the Classic account

- Does not accept US traders

LiteFinance Account Types

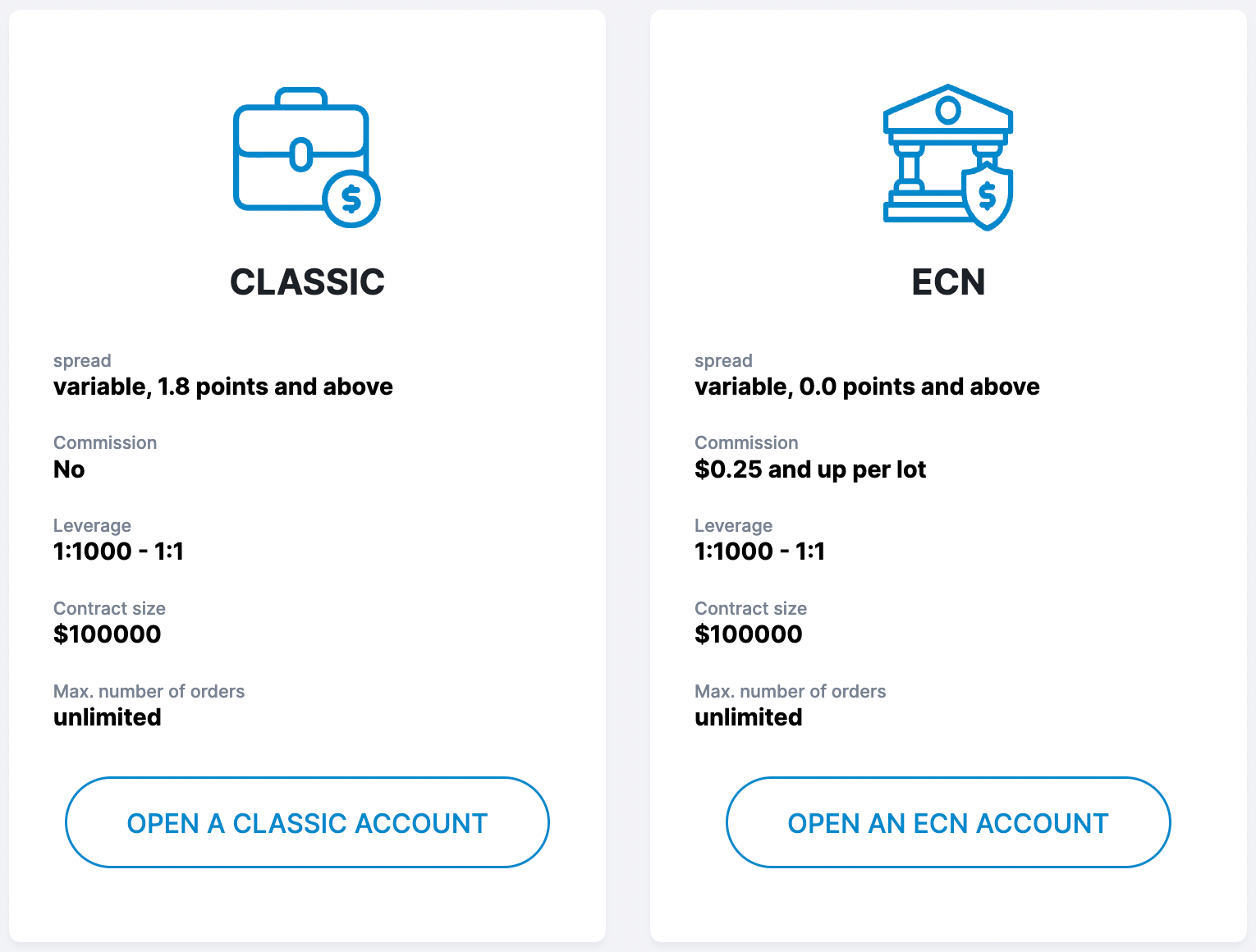

LiteForex Investments Limited offers two primary live accounts, the ECN Account, and a Classic Account.

ECN Account

LiteForex Investments Limited recommends the real-trading ECN (Electronic Communications Network) account for professional traders and investors. This account offers an interest rate of 2.5% on surplus funds, an unlimited duration of transactions and trades are delivered directly to liquidity providers. Only the MT4 platform is available to holders of an ECN account.

Classic Account

The Classic account is available to experienced traders. No commissions are charged, or interest paid on surplus funds. Both the MT4 and MT5 trading platforms can be used by traders. The minimum deposit required to open the account is only $50.

Trading Platforms

LiteFinance maintains the out-of-the-box MT4/MT5 trading platforms, but no introduction exists. LiteForex merely presents them as two buttons and clicking on them redirects to an account opening page. Both are available as desktop clients, webtrader, and mobile apps. LiteFinance also offers a lightweight web-based browser with a user-friendly interface. It is ideal for manual traders and superior to the MT4/MT5 web-based alternatives.

Trading Instruments

LiteFinance maintains a wide range of trading instruments, advertising 145+ on its website, offering 225. Over the past twelve months, it made the most notable expansion in cryptocurrencies, where it offers 53 assets, including crypto-to-crypto crosses.

Equity traders get access to large-cap names trending on social media. They are suitable for most retail traders, but seasoned traders require higher quantities. While the 225 assets offer new traders acceptable entry-level exposure, advanced traders will find it inadequate for proper cross-asset diversification.

Spreads

The broker takes its fee from the spread. Spreads are specific to the account and asset being traded. The Classic account uses a spread-based system and the ECN account, a commission-based system. With the latter, commission is charged at $0.5 per lot alongside spreads from 0.0 pips. Spreads on the Classic account are relatively high, starting at 1.8 pips but with no commission.

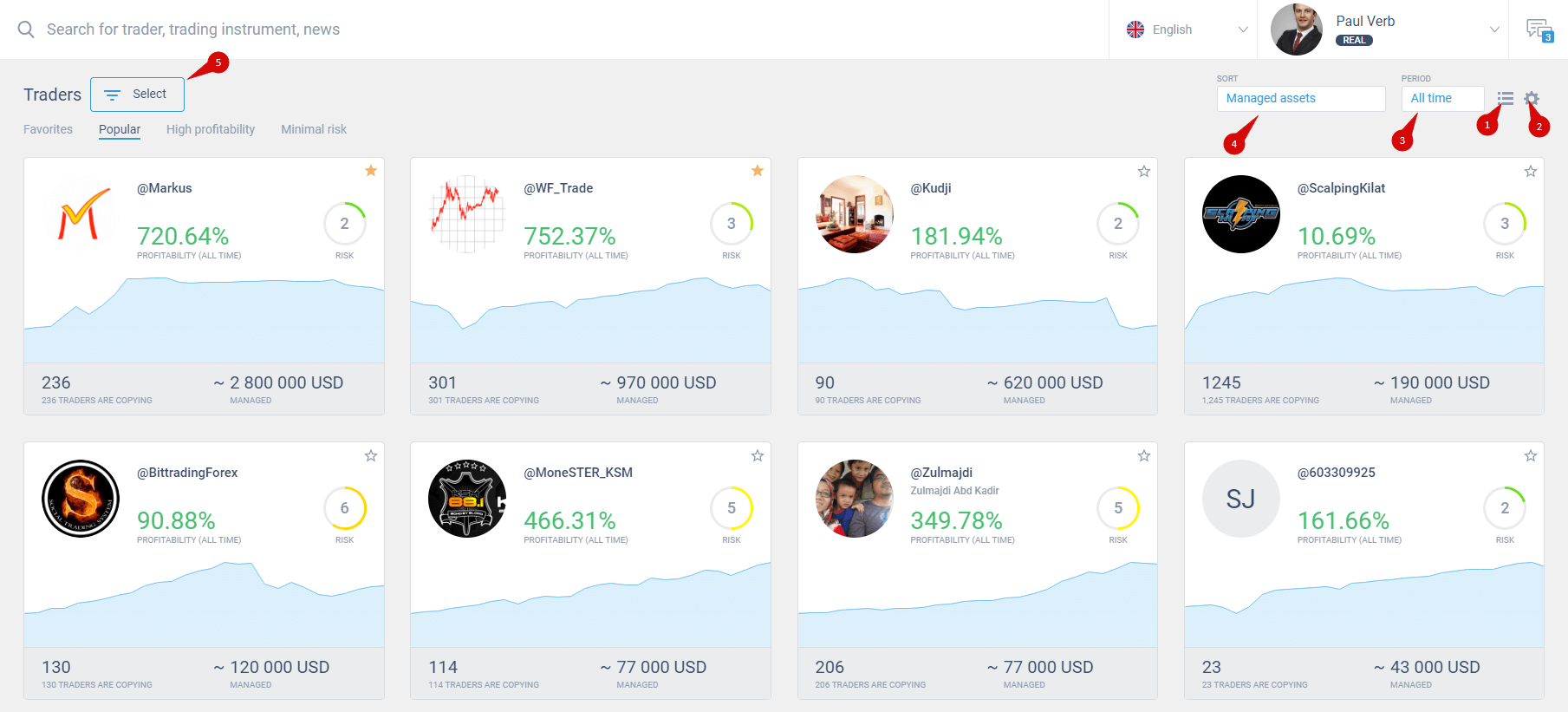

LiteFinance Social Trading

Use copy trading to discover the world’s most successful traders or become a laundry legend. The automatic copy trading system Soсial Trading allows you to copy the best trades, trade independently, share information and communicate with your suppliers.

Through LiteFinance’s copy trading system, you can adopt the experience of successful traders or share your own success with others. Specify your goals, choose the role that suits you, and achieve your goals!

A professional network for traders to copy trades on the financial markets Synchronize your trades with a provider of successful trading strategies! Profit by copying trades of successful traders: become a copycat or a fan, copy trades, chat, earn money.

Deposits and Withdrawals

Traders will conduct all financial transactions from the secure back office of LiteFinance. We find the deposit and withdrawal methods sufficient for most traders and appreciate the inclusion of cryptocurrencies.

Bottom Line

We like the trading environment at LiteFinance for cryptocurrency traders who seek a copy trading service. LiteFinance, previously known as LiteForex, faces technical issues and experiences a rise in fraud claims. The unexplained move of its headquarters from one unregulated Forex jurisdiction to another raises red flags. Since rebranding, LiteFinance lacks transparency across its core trading environment. Until this broker fixes its issues and returns to the same standards established over 15 years as LiteForex, I advise extreme caution.

LiteFinance Forex Short Review

Low - Variable

Low - Variable