Plus 500 Review

Table Of Content 👇

| 💱 Instruments | CFDs on Currencies, Indices, Options, Shares, ETFs, Cryptocurrencies – Availability subject to regulation |

| 💳 Funding & Withdrawal | Credit Card, Skrill, PayPal, Wire Transfer, ideal, Bpay, Klarna, giroPay, Trustly, Przelewy24, Multibanco, MyBank, Blik |

| 💻 Broker Type | Broker |

| 👨🏽💻 Account Types | Demo, Retail Account |

| ⌛️ Language | English, French, Italian, Spanish, Portuguese, German, Dutch, Polish, Arabic, Hebrew, Danish, Norwegian, Czech, Slovak, Bulgarian and Chinese |

| 🎮 Virtue | Unlimited demo account |

Visit Broker

Pros / Cons

- Min. deposit from $100

- CFD broker established in 2008

- 77% of retail CFD accounts lose money.

- Used by 430000+ traders

- Well-regulated CFD provider, including FCA and ASIC

- Helpful & Quick customer support

- Free withdrawal

- Inactivity fee charged only if you don't log into the platform

- Over 2000 tradable CFDs

- Unlimited demo account offered

- User-friendly platform

- Reliable and valuable customer support

- They provide a wide selection of assets to choose from

- Both ETFs and Options trading are available

- The trading platform is extremely user-friendly

- It is compatible with all major mobile and web browsers

- European traders protected by ICF

- Money protection with segregated bank accounts

- Worldwide presence with offices in key markets

- Regulated and compliant

- Easy demo account opening

- Access to more than 2,000 CFDs

- Average CFD fees

- The spreads could be a little lower

- Fixed leverage is applied that could be risky for some

- The guaranteed stop loss is not available for all the instruments

- Technical chart analysis is quite limited

- No social and copy trading features are provided

- United States customers not accepted

- MT4&MT5 not supported

Plus500 is a large international CFD broker founded in Israel but with its main offices located in Haifa, Israel. The broker is regulated by the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), Australia’s ASIC, and many other regulators from around the world. A potential issue with Plus500 for some traders is that the broker does not work with established trading platforms like MetaTrader 4 and 5. This means that it is not possible to use the many trading strategies and indicators that have been developed by technical analysis enthusiasts for MT4 & 5 over the years. For traders who only use the standard technical indicators, however, this should not be a problem.

Account Types

Plus500 only offers one account type, which is often referred to as a Retail account. You can apply for a Professional account if you meet two of the following three criteria:

- Sufficient trading activity in the last 12 months

- Financial instrument portfolio over €500,000

- Relevant experience in the financial services sector

We identified three major account types in the Plus500 Platform, and these are these instructions:

Demo Account

Plus500 offers an unlimited demo account that does not expire. You can open a demo account to try the CFD platform, learn Forex basics, or just to learn and test new strategies every single day.

The demo account does not require you to fund your account with real money as all tradable assets are virtual and you will trade with zero risks. That’s why these options are also known as paper trading accounts. Of course, both earnings and losses are virtual.

Standard Account

The flagship and more popular account in Plus500 is the standard account. You can start trading with just $100 after completing an opening process based on regulatory rules.

To create a standard account, you only need your ID or passport, proof of residency, and fill out a brief form. You can then fund your account with an initial deposit of $100.

With Plus500, you don’t need to download any software as the CFD provider offers its own online trading platform.

Professional Account

A professional account is a direct service to users registered with Plus500AU Pty Ltd, Plus500UK Ltd, and Plus500CY Ltd. To be eligible for a professional account within the EU or the UK, you must comply with at least two of the following requirements:

- An average of 10 transactions of significant size per quarter in the past year

- A financial instrument portfolio of over €500,000 (in your bank or your trading account)

- Relevant experience in the financial services sector

- Professional traders don't have ICF rights

If your CFD provider is Plus500 Australia, you must meet one of the following criteria:

- Net assets of at least 2.500.000 AUD (including properties, businesses or other investments)

- A gross financial income of at least 250.000 AUD in the past two years

After opening the professional account, you will be granted such exclusive benefits, leverage up to 300:1 on Forex and rebates from Plus500. As another layer of protection, Plus500 maintains your negative balance protection with the professional account but professional traders don't have ICF rights.

How to open your account

If you want an efficient and digital account opening process, Plus500 is the provider you should choose

After the online registration, you have to verify your identity and provide proof of residency. You can upload a copy of your ID or passport to verify your identity, and a bank statement or utility bill to verify your residency. Alternatively, you can use a driving license or a residence permit for ID verification, or a toll taxes letter, salary slip or address card to verify your residency.

Markets & Instruments

Customer review and ratings are positive of the breadth of products on offer. Users can trade in:

- Stock CFDs – 2000+

- Spot Metals – 7 precious metals

- Spot Energies – 3 energy commodities

- CFDs for Currency Pairs – 70 FX pairs

- Market Indices – 19 spot market indices

- Cryptocurrency CFDs – Availability subject to regulations.

The broker’s extensive selection of global stock CFDs is particularly impressive. Clients can diversify their portfolios with assets from a range of industries and countries.

Spreads & Commissions

Plus500 offers commission-free trading with tight spreads on a variety of different asset classes. Additional fees include:

- Overnight funding charges – added or subtracted from your account when holding a position overnight.

- Currency conversion – if trading instruments denominated in a currency different to the currency of your account.

- Guaranteed stop order – fees are built into the spread.

- Inactivity fee – if a user has not logged into their trading account for at least three months, $10 per month fee will be levied.

Plus500 offers tight spreads and users can view live spread information in the free to use demo trading account or on the broker’s website under the instrument they wish to trade. This area also provides details on the overnight funding charge for buying and selling.

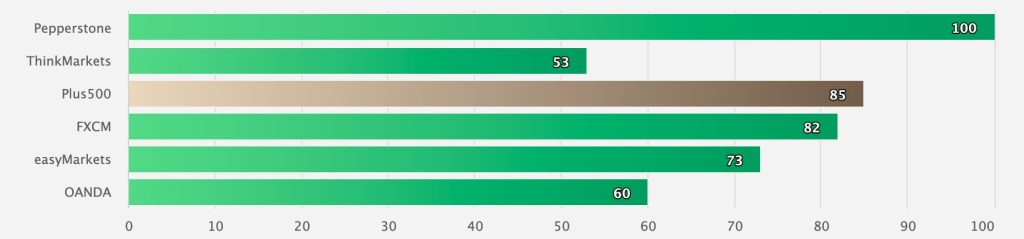

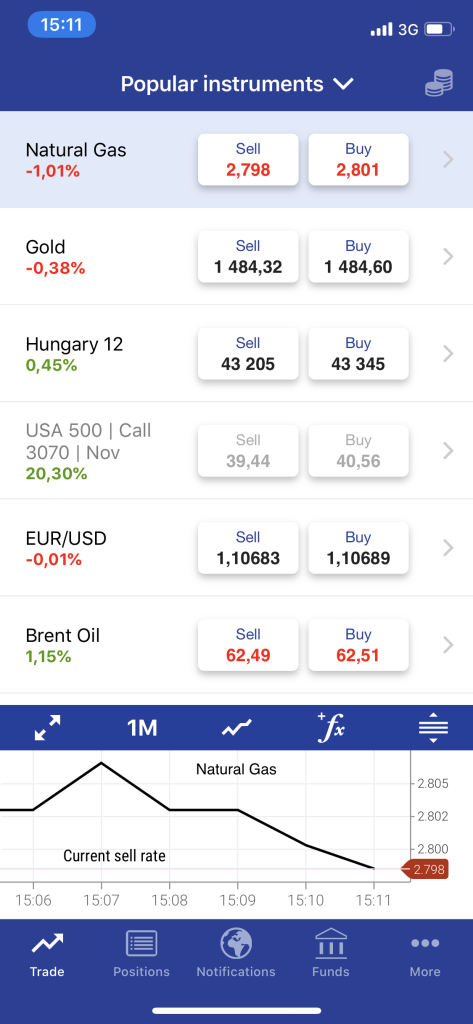

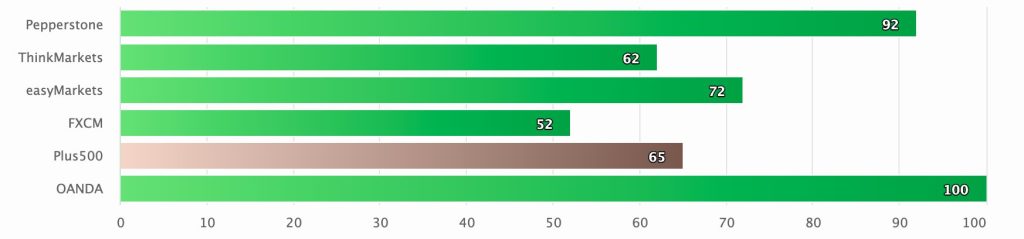

Plus500 earns money through the difference of bid/ask spreads when users trade the financial instruments offered by the online provider. As seen below, Plus500’s spreads are very competitive compared to other local forex and CFD providers.

This CFD broker offers variable spreads, while other financial instruments are offered with a dynamic spread. The average EUR/USD spread is variable.

The only other fees Plus500 charges is for long-term currency holding (1+ hour or overnight fee) and an amount of $10 USD if you don’t use your account for 3 months (inactivity fee). View the full fee article for greater detail on Plus500 fees.

Plus500 trading fees are average.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We selected popular instruments within each asset class:

- Stock index CFDs: SPX and EUSTX50

- Stock CFDs: Apple and Vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For the volume, we chose a $2,000 position for the stock index and stock CFDs and $20,000 for the forex transactions. The leverage we used was:

- 20:1 for stock index CFDs

- 5:1 for stock CFDs

- 30:1 for forex CFDs

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Here is the verdict for Plus500 fees.

CFD fees

Plus500 has generally average CFD trading fees.

There is no commission: everything is included in the spread when trading CFDs with this provider, i.e. the difference between the ask and bid prices. ActivTrades is a provider you should consider for lower fees. Spreadex also has lower fees.

Forex fees

Plus500 forex fees are average. Again, no there is commission, and everything is included in the spreads.

Non-trading fees

Plus500 has average non-trading fees. Plus500 charges no withdrawal, account, or deposit fees.

On the other hand, there is an inactivity fee of $10 per quarter after 3 months of inactivity. You can save having to pay the inactivity fee if you simply log in to the platform. In the case of some other brokers, you have to trade in order to not be charged an inactivity fee, logging in is not enough. There are some more fees for which you can find information here.

Leverage

The maximum leverage at Plus500 depends on the regulatory authority. Tha maximum leverage at Plus500 is 1:30.

| Pairs | Leverages |

|---|---|

| Currency Pairs/Forex | 1:30 |

| Cryptocurrency Pairs/Crypto | 1:2 |

| Commodities | 1:20 |

| Indices | 1:20 |

| ETFs | 1:5 |

| Options | 1:5 |

Leverage is fixed at cryptocurrencies 1:2 on Bitcoin. While Plus500 is a good crypto CFD platform, it may not be ideal for complete beginners due to the fixed leverage increasing risk.

Plus500au Pty Ltd is the Australian regulated subsidiary of Plus500 for Australian traders. The head office is in Sydney (1 O’Connell Street) and trades under AFSL #417727. This means they are regulated by the Australian Securities and Investments Commission (ASIC regulated). ASIC allows retail traders to access maximum leverage of 30:1 for forex CFDs.

- The UK: Max leverage 30:1 under the Financial Conduct Authority (FCA) in the United Kingdom. Plus500uk Ltd with FRN 509909.

- Europe: Max leverage 30:1 under The Cyprus Securities and Exchange Commission (CySEC). plus500cy LTD licence number 250/14 and

- Singapore: Max leverage 20:1 under The Monetary Authority of Singapore (MAS). Plus500SG with licence Number CMS100648-1.

- New Zealand: Max leverage 30:1. FMA under FSP #486026

- South Africa: Max leverage 30:1, FSCA 47546.

- The Seychelles: Max leverage 300:1, Financial Services Authority (FSA)

- Head office is in Israel.

Minimum Deposit

The Plus500 minimum deposit is $100 for debit/credit cards and electronic wallets and $300 for bank transfers. There's no account type minimum deposit at Plus500. The minimum deposit is $100 as there's only one account type.

Plus500 supports 5 depositing methods including debit and credit cards, bank transfer and electronic wallets (PayPal or Skrill).

Trading Platforms

Plus500 offers its proprietary trading platform. I recommend the lightweight webtrader, as the functions remain the same. It is also available as a mobile app. The trading platform is user-friendly but does not support algorithmic or social trading.

| Platforms | Status |

|---|---|

| MT4 | No |

| MT5 | No |

| cTrader | No |

| Proprietary/Alternative Platform | Yes |

| Automated Trading | No |

| Social Trading / Copy Trading | No |

| MT4/MT5 Add-Ons | No |

| Guaranteed Stop Loss | Yes |

| Negative Balance Protection | Yes |

| Unique Feature One | Broad asset selection |

| Unique Feature Two | User-friendly trading platform |

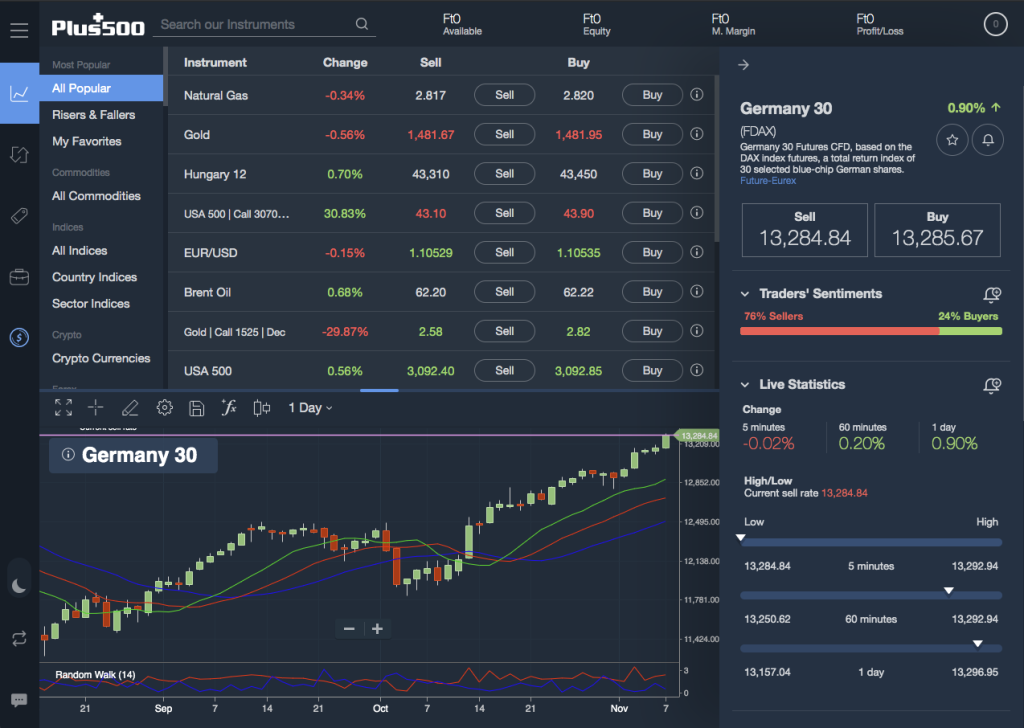

Web Trading Experience

The Plus500 web trading platform is very user-friendly and easy to begin with compared to other trading platforms. It offers both dark and white themes and provides multiple charting analysis tools. Though the layout could be improved, it is easy to understand and to use. The web platform is compatible with any browser.

The Plus500 web platform has a clean, well-designed look and is easy to use. You can choose a dark mode as well.

On the downside, you cannot customize the platform.

Illustrative Prices

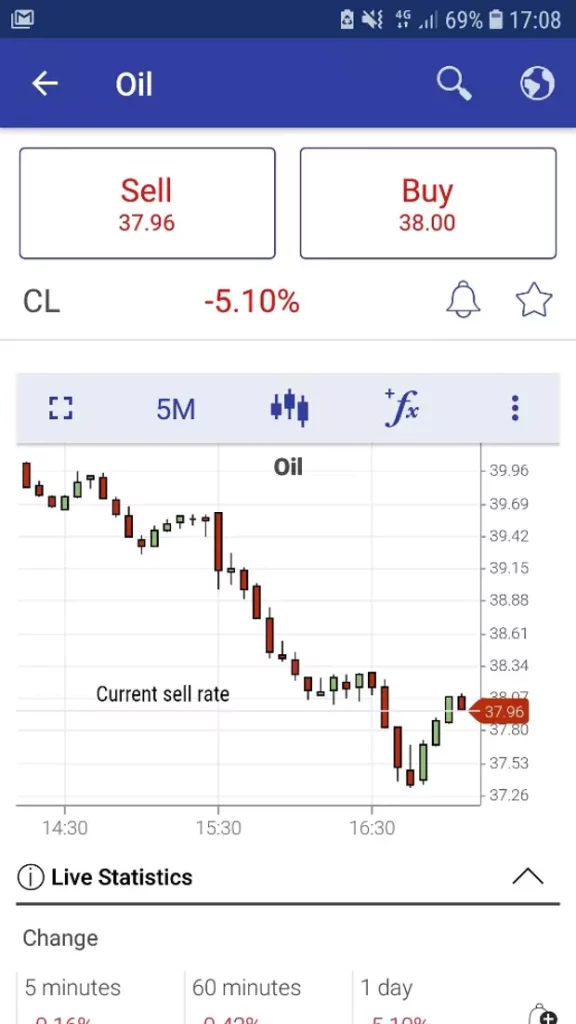

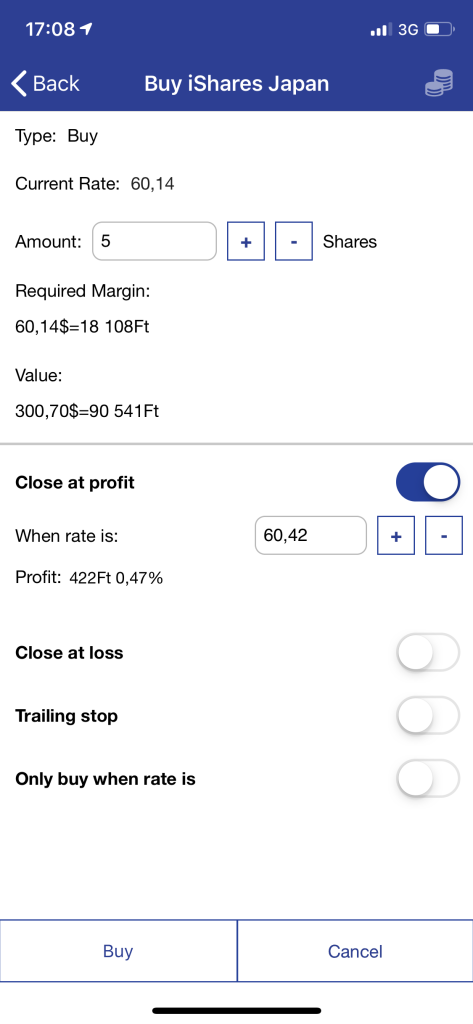

Mobile Experience

The Plus500 mobile app is available for Android, iOS, and Windows mobile phones. The app offers all features found in webtrader platform, including risk management. You can configure the app to send you notifications with trading ideas and alerts.

Mobile price alerts are available. Traders simply need to select the instrument, decide which price to alert (bid or ask) and then choose to alert when the price is higher or lower than a selected level. The trader can even create a customized pop‑up message to deliver as well.

The Plus500 mobile platform is very similar to the web platform. It has the same functionalities and is also user-friendly: same order types, same options for notifications, which is, of course, a great addition for investor accounts to not to lose money when trading with CFDs, as they may be notified of sudden price changes earlier than expected.

You can download the mobile app for iOS, Android, and Windows. You can also use your smartwatch, but we stuck to a conventional smartphone and tested the mobile iOS app. It was great.

Plus500 provides a safe two-step login and you can also use biometric authentication, which is a convenient feature.

Illustrative Prices

Mobile Trading Platforms

“Plus500 offers users the ability to trade on its propriety, feature-rich mobile trading app for Android and iOS users.”

Plus500 offers users the ability to trade on its own proprietary, feature-rich mobile trading app for Android and iOS. The app download links can be found on the broker’s website, or in the Google PlayStore or Apple AppStore.

The Plus500 mobile trading app offers the ability to:

- Trade on more than 2,500+ instruments

- View real-time price quotes

- Trade and manage your account on the go

- Access an economic calendar for market events

- View different types of charts and timeframes

- View a range of technical trading indicators

Below is a screenshot of the Plus500 mobile trading app which is covered in more detail in the video review.

Markets

As Plus500 is a CFDs platform, every asset listed on the platform is offered in CFDs. You do not own the underlying asset but trade the difference between opening and closing price. Here are the markets that Plus500 supports.

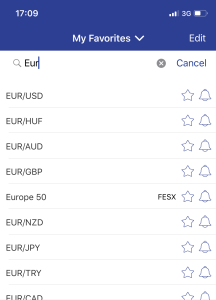

Forex

More than 60 forex pairs available including mayors, minors, crosses, and exotic pairs.

Commodities

Plus500 offers only gold, oil, and natural gas. However, there are plenty of commodities options related to these assets.

Indices

28 Indices available including Germany, Netherlands, Italy, UK, EU50, NASDAQ and S&P 500

Crypto

14 cryptos feature the most common ones such as bitcoin, ethereum, litecoin, ripple and more. Plus500 offers crypto-to-crypto and crypto-to-fiat trading.

“Availability subject to regulations”.

Stocks

Over 1,800 stocks from all around the world, including equities from Europe, Japan, Australia, USA, Singapore, Hong Kong, and South Africa.

ETFs

Over 90 ETFs distributed in various types of instrument-based market sectors, industries, major indices and other kinds of assets.

Products

Plus500 offers a user-friendly and very basic platform. It provides both basic and advanced trading tools for all needs.

Plus500 Trading Platform

This review found that the Plus500 trading platform is one of the best proprietary platforms in the industry. Its offering is vast and includes the most popular markets and a large number of trading instruments via CFDs.

Finally, Plus500 provides its users with a top-quality economic calendar, high class analysis, and much more.

Social Trading – Copy Trading

Plus500’s overall leitmotiv is to keep things as simple as possible. Although for many clients this approach works well, it does mean that Plus500 lacks some secondary products like copy and social trading.

The only quasi-social feature provided by Plus500 is the trader sentiment tool which is a bar that visualizes the ratio between bulls and bears in the market. However, remember that this feature is also based on the internal ecosystem of a CFD market maker provider.

Money Protection

Plus500 has a Client Money Protection program which is a series of measures that the CFD provider takes to protect clients’ money.

First, all money deposited by clients in the Plus500 platform is allocated in segregated bank accounts in line with the Financial Conduct Authority so your money will be safe in case of bankruptcy or insolvency. In such an event, your money will never be touched.

Also, your account is not allowed to incur a negative balance since negative balance protection due to a regulatory requirement with Plus500 complies. You can only trade what you have as balance. That means that you cannot lose more money than you deposit.

Finally, UK users registered with Plus500UK Ltd have the ICF extra protection: up to £85.000 for UK traders in case something happens to your money.

Note that there is no Investor compensation fund for Plus500AU and the Client Money Protection does not refer to one.

Regulations

“Plus500 holds multiple regulations from around the world which include the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and the Monetary Authority of Singapore (MAS), among others.”

Plus500 is regulated around the world by some of the major financial regulators. For example, Plus500UK Ltd is authorised and regulated by the UK Financial Conduct Authority, as shown below:

Plus500 is also authorised and regulated around the world, as follows:

Plus500UK Ltd authorized & regulated by the FCA (#509909).

Plus500CY Ltd authorized & regulated by CySEC (#250/14).

Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

Plus500SEY Ltd is authorised and regulated by the Seychelles Financial Services Authority (Licence No. SD039).

Plus500AU Pty Ltd (ACN 153301681), licensed by: ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the broker’s website.

All subsidiaries offer further client protection by holding client money in segregated accounts and by providing a negative balance protection policy which is a regulatory requirement for all European brokers and are therefore obligated to provide it.

Customer Support

Within global financial markets, Plus500 is one of the most reputed CFD traders with high turnover and outstanding corporate governance. The CFD provider makes use of the latest security protocols and technology. By total number of relationships with UK CFD traders. Investment Trends 2020 UK Leverage Trading Report. As far as customer support is concerned, Plus500 offers bilingual support, which is comprehensive with fast responses. Support is also 24/7 with chat support in 16 different languages. An even greater advantage is the fact that the platform is available in over 30 languages, meaning issues are resolved in a timely manner.

Plus500 Staff Support

When completing this review, we found Plus500 staff members to be cordial and efficient. They provided immediate attention to our enquiries, and we didn’t encounter any delays in their responses. Customer support is available in several languages via email and live chat. Another positive feature of Plus500 is the numerous “Traders Guide’s” available to customers on the main website.

No immediate support

Although the customer support of Plus500 is listed as a strength and remains so, one concern for Plus500 LTD is their lack of immediate contact. Although they have email addresses, live chat, there is no direct phone line. As such, customers with pressing issues are unable to make fast contact with the CFD provider. As the industry of forex trading happens very fast, with decisions sometimes needing to be made quickly. This really needs to be addressed for Australian fx traders.

Downsides and Advantages to consider before starting

Downsides

First looking at the downsides of Plus500, they do have a high inactivity fee of $10 per month so not perfect for casual trading. Also, they feature a high conversion charge of 0.7% if you are trading with a different currency than that which you opened your account with.

You will also note they have limited deposit methods typically available with just bank wire, Visa, Mastercard and Skrill possible with the minimum deposit for a bank wire being high at $500. On the trading side, the CFD platform has just a limited selection of research tools and a slim educational offering.

Advantages

Several positive points about Plus500 include they have trusted reputation.

They utilize segregated bank accounts for EU traders and Australian traders. All client funds are held in a segregated client bank account in accordance with the Cyprus Securities and Exchange Commission’s (CySEC) client funds rules.

The account opening process is also convenient and fast with a minimum deposit typically of just $100 and an unlimited demo account to try out on their very user-friendly and proprietary trading platform. Finally, in trading, even though the spreads are a little higher they remain competitive as there are no additional commissions beyond the spread amount.

| Plus500 Offer | Advantages | Downsides |

|---|---|---|

| Demo Account | Unlimited demo account | The capital of virtual funds can be too high respect to the actuality of a classic user |

| Minimum Deposit | $100 minimum account for credit cards | $500 if you use wire bank |

| CFDs | More than 2000 assets | Spreads are a little higher compared to other providers; Trading conversion fee up to 0.7% |

| CFD Crypto/Bitcoin | 14 crypto offered; crypto-to-crypto |

Fixed leverage which cannot be changed

“Availability subject to regulations”. |

| Trading Platform | Easy to use; Available via webtrader and mobile |

Limited chart tools; API not supported |

PLUS 500 Short Review

Final Thoughts

Disclaimer: 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Low - Variable

Low - Variable